Nonprofit Fiscal Watchdog Fears Massachusetts Will Act To Make Donor ID’s Public

By Evan Lips | February 13, 2018, 17:48 EST

(Courtesy of Wikipedia)

(Courtesy of Wikipedia) BOSTON — A series of proposed changes to state campaign finance regulations has organizations like the Massachusetts Fiscal Alliance concerned that the public disclosure of those donating to nonprofits could happen seemingly overnight, with state statutes changing despite the Legislature not lifting so much as a finger.

Paul Craney, who heads the conservative-leaning Beacon Hill spending watchdog, spoke out against the proposals during a hearing held at the state Office of Campaign and Political Finance on Tuesday morning. Following the hearing, Craney told New Boston Post that his concern is that campaign finance agency could abruptly change the rules and commence a repeat of what happened in 1988 — the year a loophole was enacted allowing even out-of-state unions to donate up to $15,000 to political candidates while banning business donations and capping individual donations at $1,000.

According to a State House News report, OCPF general counsel Gregory Birne claimed that the proposed regulations are “intended to clarify existing regulations” and are additionally mean to “respond to frequently asked questions and changes in state law.”

The latest proposal agency officials are floating would give the agency the power to rule unilaterally that a donor “had reason to know” how a donation would be spent, which under the rules would give the agency the authority to disclose that donor’s identity. A secondary measure would strip donors of the opportunity to challenge a decision by the agency to disclose a donor’s identity.

Craney argued that such a revision to the state statute should only be enacted by the state Legislature, which in 2016 passed a series of statutes that increased election-related donor transparency.

“We think the changes are far too substantial to make administratively,” he said. “I was seven years old the year that OCPF came up with the union loophole through a regulatory interpretation by a void in the statute.

“We’ve seen the repercussions of it since.”

Tad Heuer, an administrative law attorney with Foley Hoag LLP who has been retained by MassFiscal, told New Boston Post that the proposed changes are “impermissibly vague.”

“This would prevent donors from knowing even beforehand whether their identities will be disclosed,” Heuer cautioned. “The basic understanding is that right now if you give a donation to a nonprofit’s general treasury, that’s not publicly disclosed, it’s money given for unrestricted use, if the donor likes what your nonprofit does.

“The concern here is that OCPF could make a disclosure determination after the fact and without even speaking to the donor.”

MassFiscal has previously drawn criticism from left-wing organizations over its practice of mailing out “legislative scorecards” to voters living in various districts showing how specific lawmakers voted on budgetary matters. MassFiscal has halted the practice, Heuer pointed out.

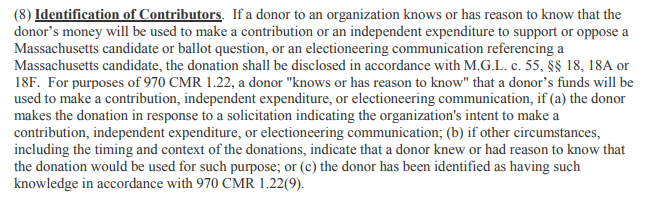

Heuer said the vagueness of the proposed measure stems from the implication that a donor “had reason to know” how and where their money would be spent, as outlined in the proposal itself:

“Those standards are simply too vague to be enforceable,” Heuer said. “We believe it’s potentially vulnerable to legal challenges.”

Heuer added that MassFiscal is also concerned with the agency’s proposal to strip “safe harbor” measures allowing donors to “present evidence that money was truly intended for unrestricted use.”

“If OCPF believes donor did something wrong, donor should have opportunity to submit evidence, show that it wasn’t intended for a specific political purpose,” Heuer said.

As for the “reason to know” standard presented in the proposal, Heuer countered that the standard ideally can only be determined in two ways.

“Either a donor responded to a solicitation you sent, or they decided to make a contribution and specifically earmarked it,” Heuer noted. “Those are the only two circumstances in which OCPF should be able to ascribe the intent of the donor.”

Craney said he thinks the proposal would set a dangerous precedent and noted that MassFiscal wasn’t the only outfit that spoke out against the proposal at Tuesday morning’s hearing — representatives from the Virginia-based Institute for Free Speech also voiced concerns.

No individuals spoke in favor of the proposals, according to a State House News Service report, while OCPF has indicated it will continue to solicit feedback regarding the measure.

“The proposal is basically saying OCPF can mind-read,” Craney said. “And there is a big push from some far-left liberal groups. This is nothing new. It creates intimidation and harassment.

“There’s a fear of that if we don’t speak up, or other groups don’t speak up, this could happen overnight just like the union donor loophole did in 1988.”

OCPF, according to State House News, plans to issue a final version this spring.

Read Heuer’s letter to OCPF Director Michael Sullivan:

Mass Fiscal – OCPF Comment Letter – 2018-02-13 by Evan on Scribd