‘Millionaire tax’ and pot legalization sponsors file signatures, point to revenue potential

BOSTON – Massachusetts voters may soon get a chance to decide whether to raise state revenue by taxing the rich, legalizing and taxing marijuana, or both.

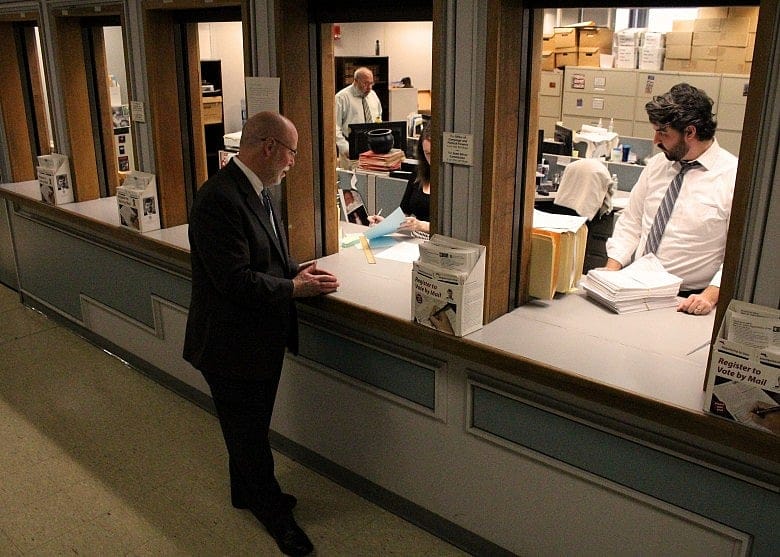

Supporters of two ballot initiatives, one that would impose a state "millionaire tax" and one that would legalize recreational use of marijuana, both claim their proposals would add cash to state coffers. Sponsors of the questions, which were certified by Attorney General Maura Healey in September, each submitted more than the required 64,750 certified signatures to the Secretary of State's office in Boston on Tuesday.