Governor’s Tax Increases Raise Eyebrows of Massachusetts Taxpayers Foundation Head

The size of Governor Charlie Baker's proposed tax increases has the head of the Massachusetts Taxpayers Foundation concerned.

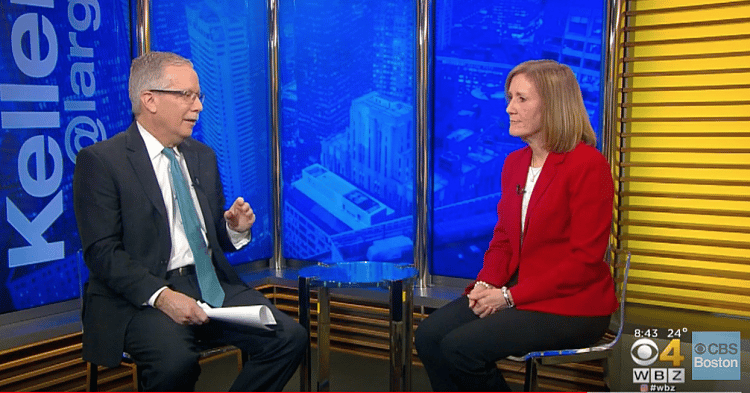

"I would say we're not anti-tax, which is an important distinction. But we do want to make sure that your tax dollars are spent appropriately and efficiently. And I have to say I was surprised by the size of the tax increases. In total it's about $600 million in new revenue that's proposed in the governor's budget," said Eileen McAnneny, president of the pro-taxpayers organization, during an appearance Sunday on Keller at Large on WBZ-TV Channel 4 in Boston. "… These are $600 million in new taxes that come on the heels of tax increases last year, as well."