News

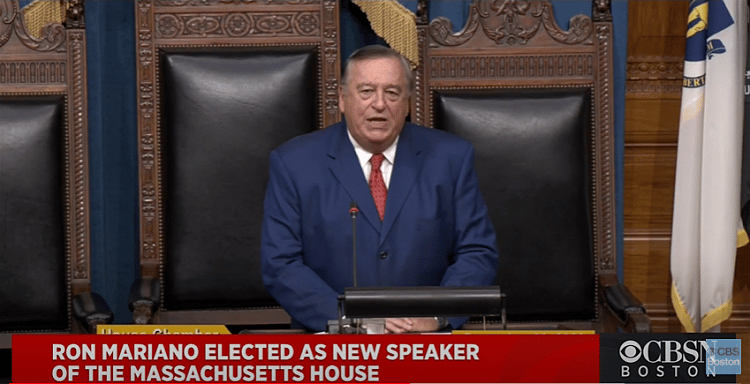

Massachusetts House Speaker Mulling Changes To 1986 Tax Relief Law

By Chris Lisinski

State House News Service