Maura Healey Supporting Millionaires’ Tax In Massachusetts

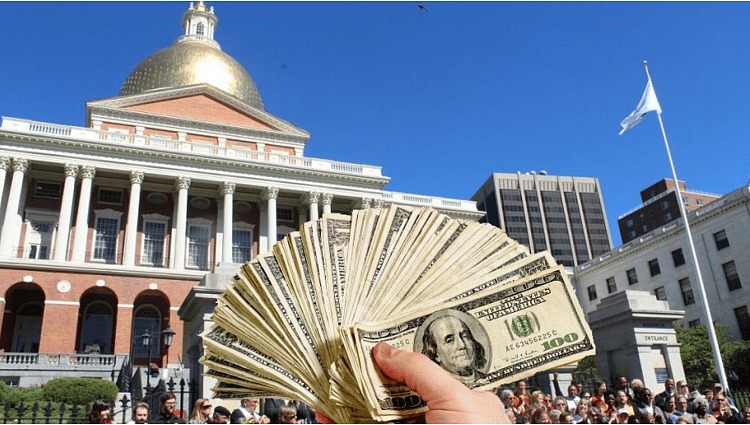

Democratic nominee for governor Maura Healey expressed support for a ballot question seeking to increase the state tax rate on incomes of more than $1 million a year on Thursday.

The ballot measure, Question 1, is formally called the Fair Share Amendment, and is also known as the Millionaires' Tax. It would increase the state income tax on incomes more than $1 million from 5 percent to 9 percent.