Baker Presses For Tax Cuts, Particularly For Senior Citizens

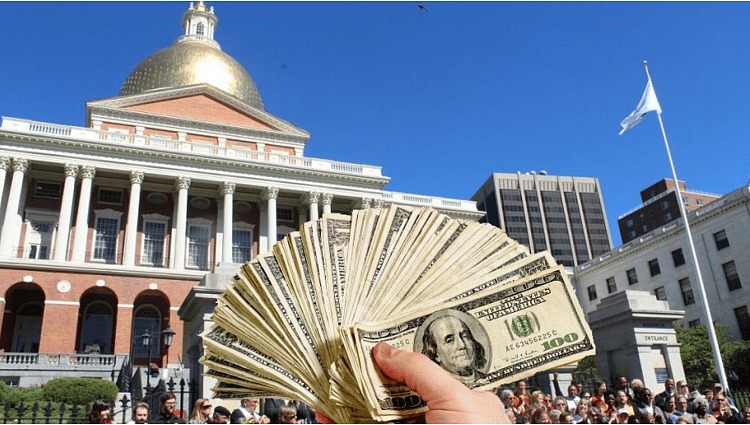

Governor Charlie Baker renewed efforts this week to get the leaders of the state legislature to incorporate tax cuts into the final state budget for Massachusetts for the coming fiscal year.

Baker called a press conference Monday primarily to talk about tax cuts for senior citizens.