The BLOG: Voices

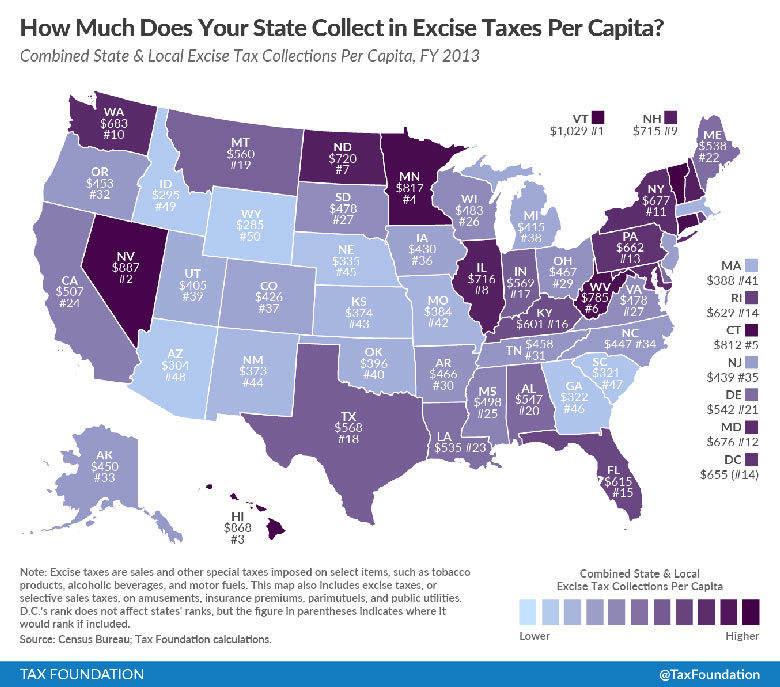

Vermont highest in nation for excise taxes

Rob Roper | August 11, 2016

The Tax Foundation recently released a study of states and the per capita burden of excise taxes on their citizens. Vermont came in first (that’s bad) with an average Vermonters paying $1,029 in state and local excise taxes per year. We blew away second place Nevada, which came in at $878 and last place Wyoming at just $285.

The Tax Foundation explains, “excise taxes are collected on specific types of transactions, not a wide range of general goods. Some of the most common excise taxes include gas taxes, cigarette taxes, and taxes on the purchase of beer, wine, and liquor. Others include taxes on the purchase of amusements, insurance premiums, and pari-mutuels.”

The insidious thing about excise taxes are that they tend to be invisible to the consumer, thus creating a lack of accountability for the politicians who pass them. Do we blame politicians and the 44¢ per gallon in state and federal excise taxes we pay on each gallon, or the “greedy” oil companies forced to pass along the tax?

Just imagine how Vermont will fare in this ranking if we pass a $500 million per year Carbon Tax, which is an excise tax on fossil fuels?

This article first appeared on the Ethan Allen Institute website.