‘Insider Trading’ Case Against N.Y. Congressman Shows Danger of Legislative Default

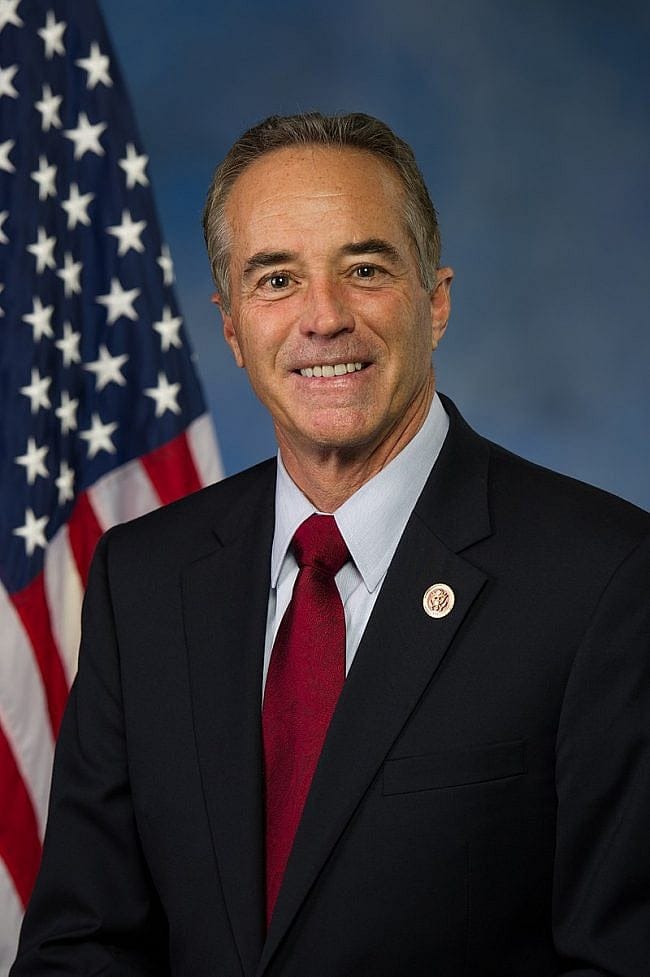

Did U.S. Representative Christopher Collins commit the federal crime of securities fraud when he spoke to his son, Cameron, on the phone shortly after he found out bad news about an Australian biotechnology company that they both held shares in?

The answer may depend in part on which one of the 12 regional federal appellate circuits hear the appeal of the case. It may depend on which three appellate judges on such a circuit happen to be chosen to hear such an appeal. Even the same three appellate judges may significantly revise their view of the matter, applied to the same facts, over the course of less than a year, so the answer may depend in part on when Collins happens to catch the judges.