Pro-Spending Democrat Seeking Joe Kennedy III’s Seat Opted Not To Pay Optional Higher Taxes

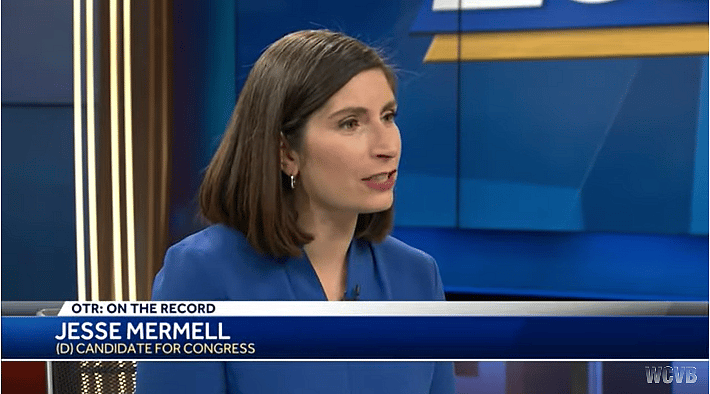

If elected to Congress, Jesse Mermell would like to implement plans that increase spending.

But when she had the opportunity to pay more in taxes at the state level over the past several years, the Brookline resident and Democrat who is running to represent Massachusetts's Fourth Congressional District chose not to, according to her tax returns.