News

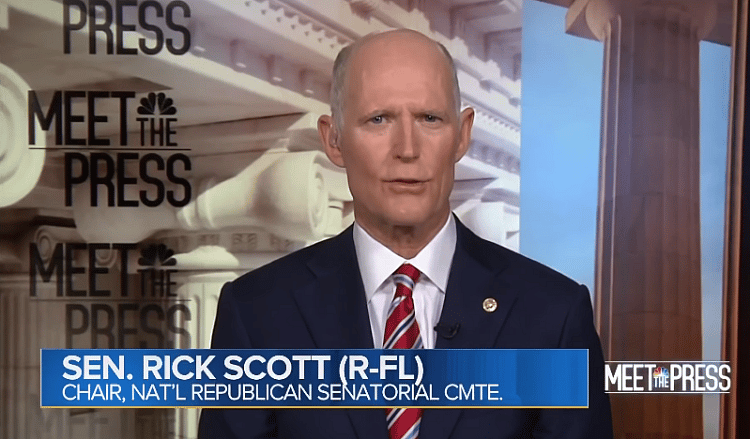

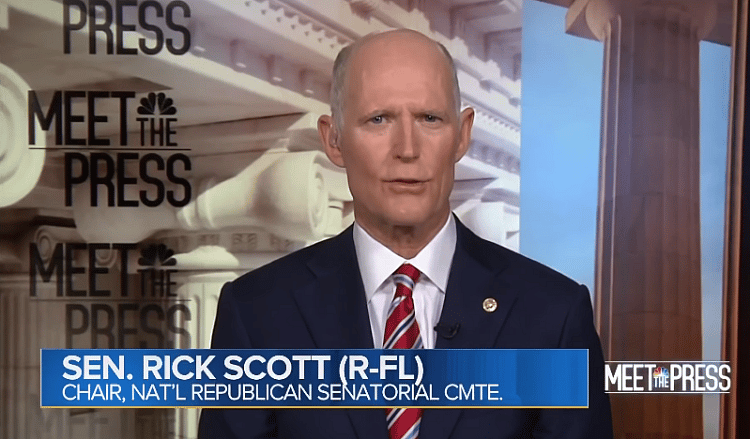

On Taxes, Republicans Like Rick Scott Shouldn’t Attack The 47 Percent

Remember when Mitt Romney ran for president in 2012 and lost?

What stood out about that campaign?