News

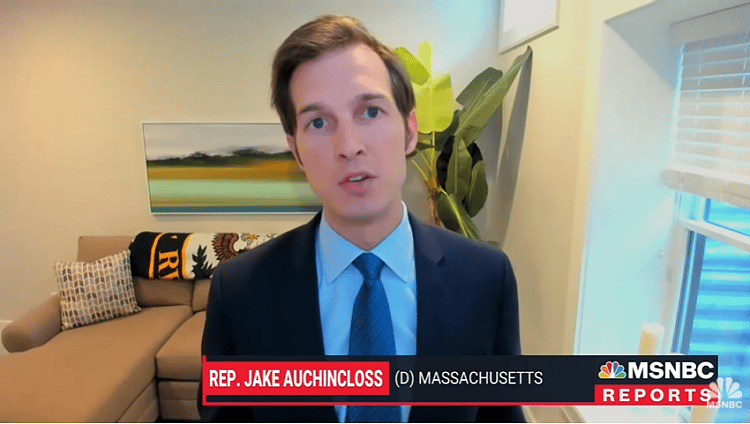

Massachusetts Supreme Judicial Court Strikes State’s Application of Capital Gains Tax

By Colin Young

State House News Service