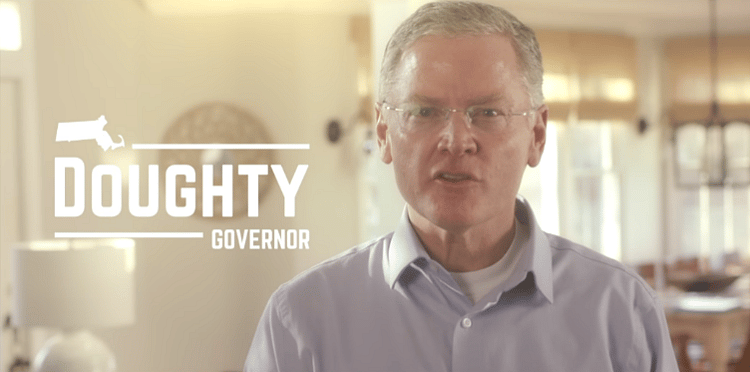

Chris Doughty Campaign Mailer Falsely Claims Geoff Diehl Opposes Sales Tax Reduction

If you got a piece of mail from Republican gubernatorial candidate Chris Doughty lately, chances are it contained false information about his primary opponent.

The Wrentham businessman is primarying former state representative Geoff Diehl (R-Whitman). At the end of last week, the Doughty campaign sent out mailers across the state that falsely claim about Diehl that "he doesn't support rolling back the sales tax" — implying that Diehl supports maintaining the 6.25 percent sales tax Massachusetts currently has.