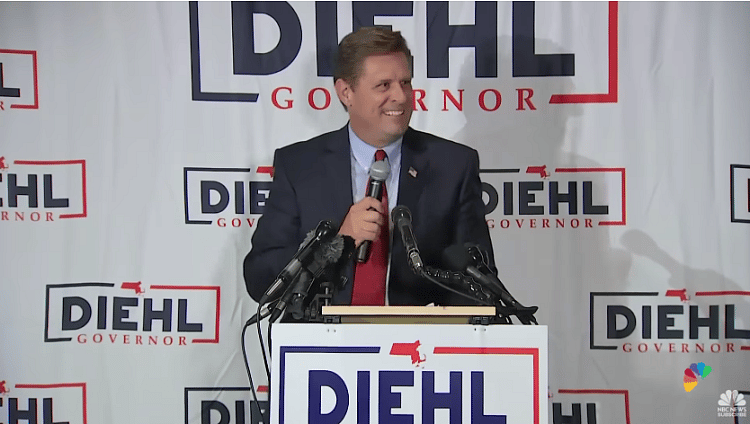

Geoff Diehl Gets Specific On Tax-Cutting Agenda

If elected governor of the Commonwealth of Massachusetts, former state representative Geoff Diehl (R-Whitman) wants to cut taxes.

But which taxes would Diehl like to see cut?

A coalition of crisis pregnancy centers in Massachusetts is calling on the state's attorney general to take action to protect them from property attacks and to withdraw a consumer advisory she issued against them earlier this summer.

"As the chief law enforcement officer of the Commonwealth, she's responsible for working to prevent violence against abortion clinics and pregnancy resource centers alike. She can't pick and choose whom she's going to protect just because she disagrees with them," said Andrew Beckwith, president of the Massachusetts Family Institute, in a telephone interview with New Boston Post on Tuesday. "She's supposed to enforce the law, not her personal or political agenda."