Around New England

Read More

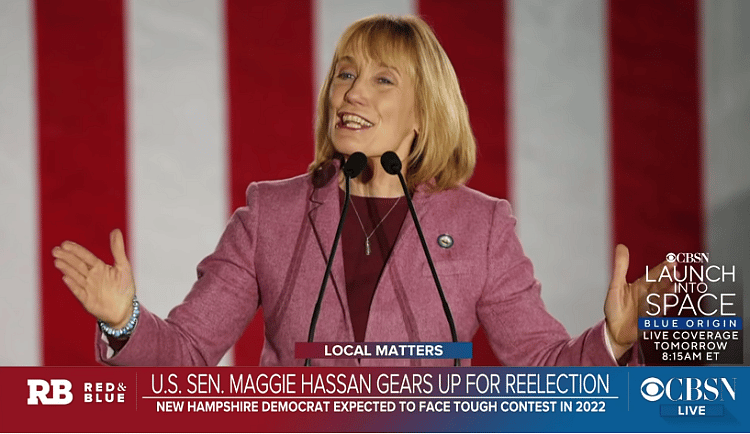

Maggie Hassan Leads U.S. Senate Poll By Double Digits

Tom JoyceWill U.S. Senator Maggie Hassan (D-New Hampshire) retain her seat in the United States Senate?

She is the favorite to do so, according to a recently-released Emerson College poll. In it, Hassan leads her Republican opponent, U.S. Army veteran Don Bolduc, by 11 points (51 percent to 40 percent).