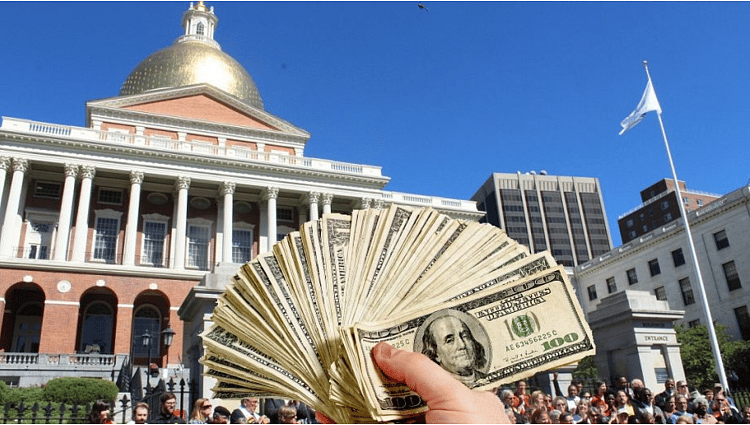

Massachusetts ‘Millionaires Tax’ Opponents Say State Government Is Taking In More Than Enough Already

Should Massachusetts raise taxes on some of the state's wealthier residents?

The Coalition to Stop the Tax Hike says not.

Envy is a powerful force in the human race. And it raises its ugly head again and again in states like Massachusetts. We hear the mantra from so-called "progressives" over and over again: "The wealthy should pay more." Or they should pay "their fair share."

This vice, or sin, of envy has been manifested throughout history. The renowned philosopher, theologian, and author Michael Novak wrote with perspicacity: "Why do republics so regularly fall? Which passion kills them? Envy, it turns out, is the most destructive passion – more so than hatred." Envy sets class against class, family against family, and tribe against tribe.