Healey Says April Dip In State Revenues Shouldn’t Nix Tax Cuts In Massachusetts

A decrease in tax revenues in April 2023 shouldn't stop tax cuts in Massachusetts, Governor Maura Healey said Friday.

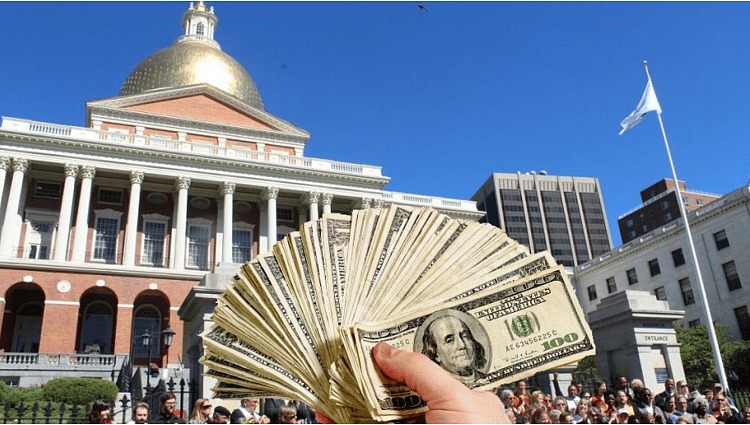

"We're talking about a tax relief package that is absolutely essential to lowering the cost of living, making life more affordable for people in Massachusetts, and also making Massachusetts more competitive so that we're able to keep our residents here," Healey said during an interview with several reporters Friday, May 5 at the Massachusetts State House, according to State House News Service.