News

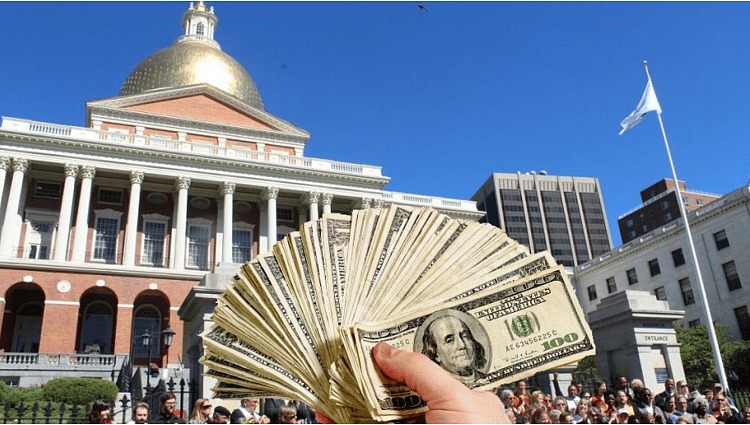

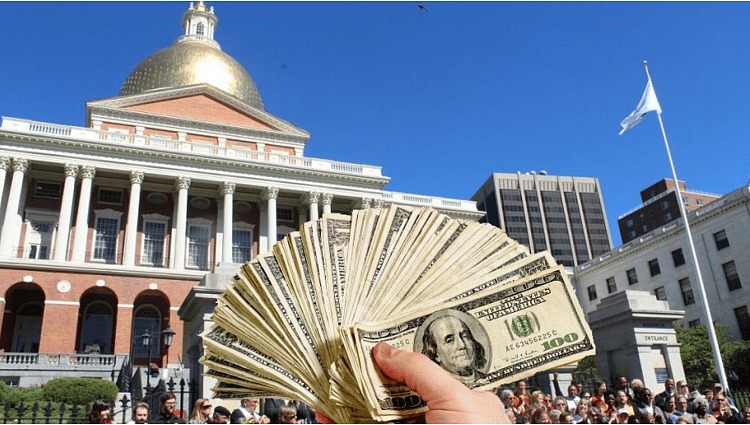

Massachusetts State Tax Collections Barely Up Through One Quarter

By Chris Lisinski

State House News Service