Around New England

Read More

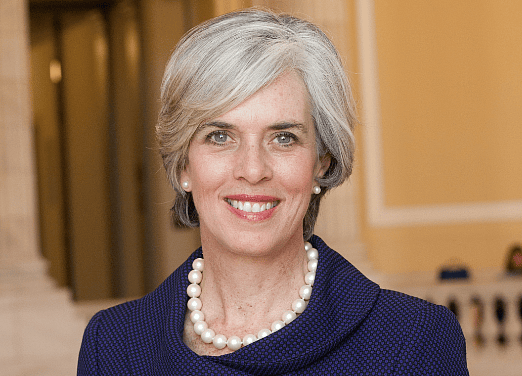

Katherine Clark Endorses Maura Healey For Governor of Massachusetts

Tom JoyceA member of Congress endorsed Massachusetts attorney general Maura Healey in her bid for governor.

U.S. Representative Katherine Clark (D-Revere) recently endorsed her fellow Democrat.