House rejects film credit cap, gas tax increase

By State House News Service | April 25, 2016, 17:31 EDT

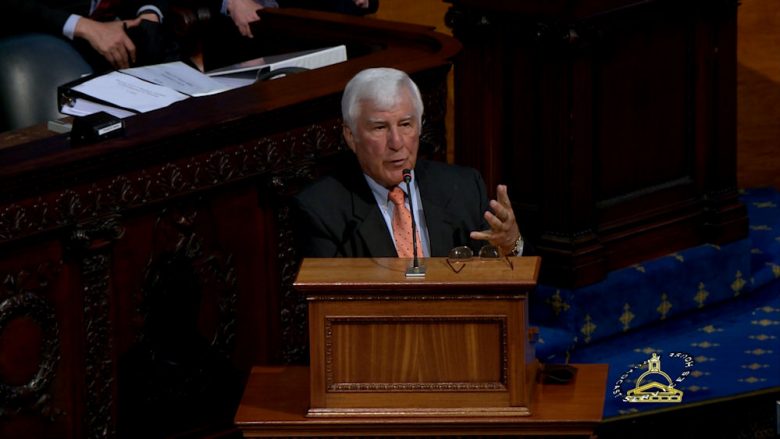

Massachusetts state Rep. Angelo Scaccia (D-Readville) called unsuccessfully for a tighter cap on the state’s film production tax credit, which he described as the “biggest boondoggle” he’s seen as a lawmaker. (House Broadcasting image via State House News Service)

Massachusetts state Rep. Angelo Scaccia (D-Readville) called unsuccessfully for a tighter cap on the state’s film production tax credit, which he described as the “biggest boondoggle” he’s seen as a lawmaker. (House Broadcasting image via State House News Service) BOSTON – The Massachusetts House of Representatives on Monday shot down proposals to increase the state gas tax and to cap the state’s film tax credit program as they began to dispense with more than 1,300 amendments to a state budget bill.

The House swiftly took care of more than 30 revenue-related amendments to the $39.48 billion proposal, rejecting four and voting to study two others. The rest were withdrawn by their sponsors after behind the scenes talks.

The gas tax and film credit amendments, both filed by Rep. Angelo Scaccia (D-Readville), were rejected on voice votes.

Calling it the “biggest boondoggle” he has seen in his long legislative career, Scaccia argued for Massachusetts to cap its film credit at $40 million, to reduce the drain it has created on state revenue. Gov. Charlie Baker has also targeted the credit, which supporters say has enabled growth in the state’s movie- and video-making industry.

“We have to get rid of this boondoggle,” Scaccia said.

House leadership has provided strong support for the credit. House Majority Leader Ronald Mariano, a Quincy Democrat, opposed Scaccia’s amendment, noting that a Braintree company employs 14 accountants who work in the sector and “wouldn’t be here if we didn’t have a film tax credit.”

Rep. Ann-Margaret Ferrante (D-Gloucester) described the credit as a benefit for parts of the state that miss out on programs geared toward urban areas or specific industries. She pointed to several movies filmed in her North Shore district, including The Proposal, The Perfect Storm and Joy.

“I don’t begrudge gateway cities and larger cities for the amount of money they get, I do not begrudge Boston from having a whole MBTA travel system,” Ferrante said. “However, it is upsetting to me when I hear folks from larger cities complain about a program that directly results in a benefit for my district and to other districts that simply do not qualify for the benefits that larger cities get. I also am concerned and upset when I see tax credits go mainly to the businesses of white-collar workers, because once again those aren’t the tax credits that benefit my district.”

Scaccia had also sought to increase the state’s tax on gasoline to 27 cents a gallon from 24 cents, saying during debate on the amendment that he was “not here to raise taxes” but wanted to address the way the state pays for transportation. The gas tax increase could help the Massachusetts Bay Transportation Authority move away from using capital funds to pay for operating expenses, which he said “does not make financial sense.”

Rep. Geoff Diehl (R-Whitman), a chief proponent of the 2014 ballot campaign that repealed automatic gas tax increases, countered that the transit agency has sufficient revenue to cover its personnel expenses and construction needs but must manage its funds better. He said the state spends over four times the national average on road repairs, and 49 percent of gas tax receipts goes to the T.

During his arguments for an amendment to study reducing the state sales tax to 5 percent from 6.25 percent, Scaccia noted that the MBTA was one of the few areas targeted for major investment in the budget.

Written by Katie Lannan