Bah humbug! No ‘sales tax holiday’ for working families

By Joseph Tortelli | August 2, 2016, 12:35 EDT

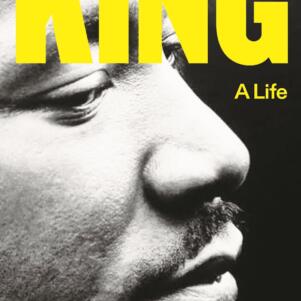

(Adobe Stock photo)

(Adobe Stock photo) If you were planning to purchase a new washing machine and dryer during the state’s annual “sales tax holiday,” you can forget about it for the next year. Massachusetts’ Democratic legislative leaders, with the acquiescence of Governor Charlie Baker, a Republican, have decided to deny consumers the 6.25 percent discount that accompanies the traditional tax-free weekend.

At a total price of $1000.00 or more for a washer and dryer, a tax holiday would save you approximately $62.50 or more, depending on the final sales figure. Add a $999.00 refrigerator to your order, and the savings would double to at least $125.00. Small change to the big spenders on Beacon Hill; real money to working families.

The “sales tax holiday” was initially implemented in 2004, when the sales tax still stood at the traditional 5 percent rate. And with once exception, the tax holiday has been a part of Bay State summers for more than a decade. Consumers and retailers have come to loo forward to it as a kind of “Christmas in August.” But this year, impersonating a summertime stand-in for Ebenezer Scrooge, House Speaker Bob DeLeo said the tax-free weekend “just doesn’t make a whole lot of sense.” His Democratic colleague in the upper chamber, Senate President Stanley Rosenberg, was more blunt: “It’s too expensive.”

“Too expensive” refers to the estimated $26 million that would stay in the pockets of Massachusetts families as a result of a “sales tax holiday.” Instead, that $26 million will fill the coffers of the state bureaucracy. Apparently, taking money away from consumers and transferring the funds to the ever-grasping state government seems to “make a whole lot of sense” to Democrats on Beacon Hill. Unfortunately, even the Republican governor remained silent, allowing the Democrats to deprive many Massachusetts families of a much needed savings, while attracting minimal press attention. Baker probably would have ultimately lost the political battle to the all-powerful Democrats in the legislature, but he could have drawn headline coverage to the issue by speaking on behalf of consumers, working families, and retail businesses.

Governor Deval Patrick and the Democratically controlled state legislature raised the state sales tax in 2009 6.25 percent — a 25 percent increase. In a double-whammy on consumers, that year, Massachusetts Democrats also eliminated the “sales tax holiday,” the only previous year it has been eliminated. The 25 percent tax hike was never rolled back, despite the fact that its regressive nature hurts poor and middle class families much more than the rich. It seems an odd way for liberal Democrats, who mouth platitudes about the plight of workers, to collect higher taxes. But, for Democrats, feeding the bureaucracy takes precedence over rolling back a regressive tax rate.

The sales tax hike also punishes brick-and-mortar businesses in Massachusetts, especially those already losing customers to sales tax free New Hampshire. In response to these cross-border challenges, the Retailers Association of Massachusetts hail the “sales tax holiday” as “the two-day equalizer.” Mom and pop retail shops, in particular, value the opportunity to compete on a equal footing with on-line sellers and New Hampshire retailers.

Jon Hurst, the President of RAM, called the legislature’s decision to kill the annual event “very disappointing.” He noted that the holiday keeps millions of consumer dollars in the local economy and results in extra work hours for retail employees, because businesses can load up on staff to meet consumer demand. According to Hurst, retailers are “losing what for some had become the biggest sales weekend of the year.”

“There is no better investment,” he lamented, “we can make to promote and preserve our Main Streets.”

Politicians defend their action by noting that the state has a budget gap exceeding $300 million. When working families face a “budget gap,” they must tighten their belts and work longer hours. When politicians see a budget gap, they simply eliminate such family-friendly occurrences as the “sales tax holiday.”

The same politicians often say that a tax-free weekend “costs” the state an estimated $26 million. The use of the verb “cost” creates the illusion that the funds already belong to the state. Somehow, that $26 million is already in the state treasury, and it will “cost” the state that sum by permitting consumers a couple of well-deserved days of tax relief.

In fact, it’s more accurate to note that eliminating the holiday “costs” consumers and working families $26 million. Those funds don’t magically come to the state, nor do they come out of business profits. Rather, the 6.25 percent sales tax forces retailers to become tax collectors for state government. For one weekend a year, eliminating the sales tax relieves retailers of that tax collecting responsibility on most purchases below $2500.00. All the costs of abandoning the holiday are borne by residents of the Commonwealth, who hold the $26 million in their savings, until the state confiscates its 6.25 percent levy upon their purchases.

Of course, the “sales tax holiday” is not some magic elixir that can cure all problems facing retailers and relieve the tax burden on working families. A far better idea would involve rolling back the sales tax to its previous 5 percent rate. But that is unlikely to happen in a state where politicians worry much about the cost to the state and little about the cost to working families.

Joseph Tortelli

Joseph Tortelli is a freelancer writer. Read his past columns here.